UK trades businesses are facing a year of tough choices and fresh opportunities, with the challenges facing UK trade businesses 2025 coming sharply into focus. Our 2025 survey of tradespeople reveals the issues from the skills shortage and rising costs to the demands of new technology and compliance. This article breaks down what’s really happening to help tradespeople and business owners looking to stay ahead. Whether you’re a sole trader or managing a growing team, here’s what you need to know.

2025 is turning out to be a challenging year for the UK’s trades. Our survey of plumbing, gas, electrics, renewables, oil, and property maintenance businesses reveals an industry under pressure but still fighting to grow. Here’s what’s really going on.

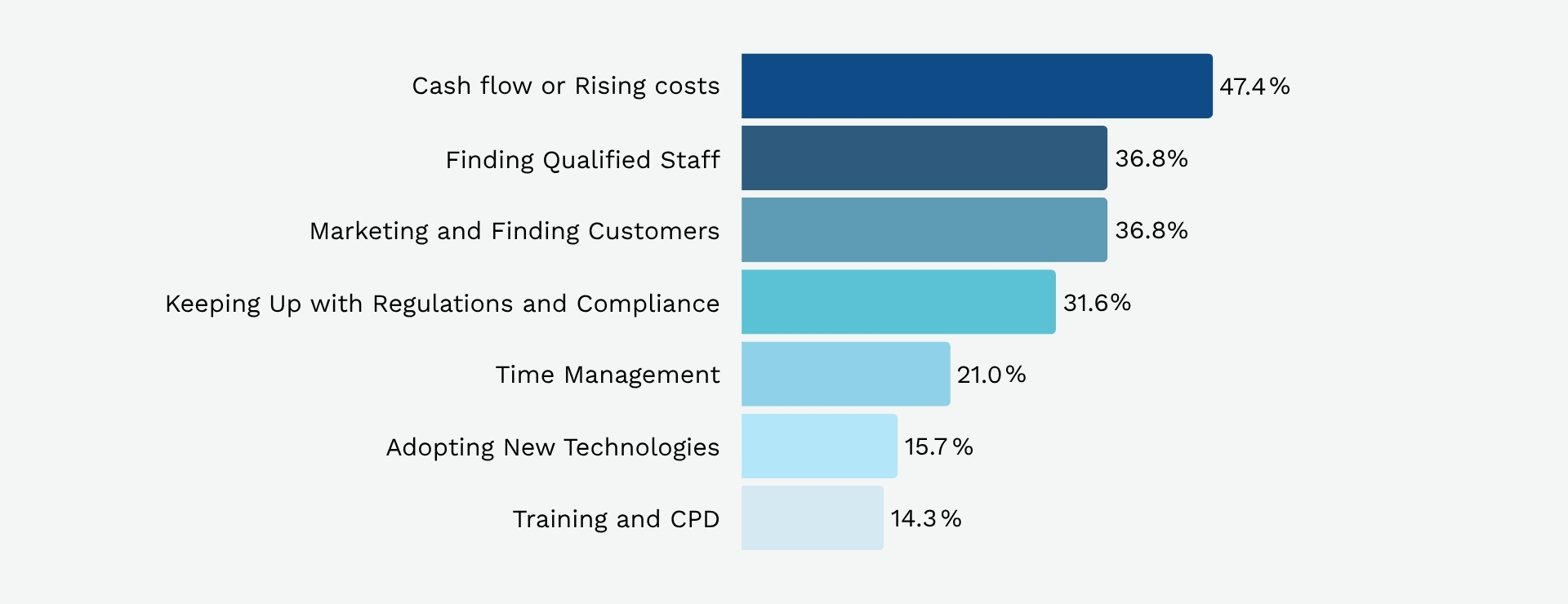

Survey Respondents’ Biggest Business Challenges

Our survey reveals a consistent set of hurdles for tradespeople and business owners across the UK.

Note: Respondents could select more than one option. Percentages reflect the proportion of respondents who selected each option, not a total of 100%

Here’s what the numbers say:

1. Cash Flow or Rising Costs

This is the single most common challenge, with over 47.4% of respondents flagging it as a top concern. Rising material prices, insurance, and wage costs are squeezing margins for businesses of every size.

2. Finding Qualified Staff & Marketing and Finding Customers

36.8% of participants list recruitment as a major issue, with the shortage of skilled tradespeople and apprentices biting hardest. The same number of participants say that attracting new business and building a strong brand is a significant challenge, particularly as competition intensifies and customers become more discerning.

3. Keeping Up with Regulations and Compliance

Around 31.6% of respondents struggle to stay on top of changing regulations. This challenge is especially acute for sole traders and small firms who lack staff dedicated to compliance.

4. Time Management

21% of respondents mentioned time management as a key headache. Balancing admin, on-site work, and customer service is a constant juggle.

5. Adopting New Technologies

15.7% are feeling the pressure to keep up with the latest tools, software, and green tech, especially as the renewables market grows.

6. Training and CPD

Only 14.3% of respondents said that training their staff was a barrier that their business found hard to overcome.

These figures highlight just how complex the landscape is for UK trade businesses in 2025. Most respondents are not just grappling with one issue, but a combination of rising costs, recruitment headaches, compliance pressures, and the need to keep up with both customer expectations and technological change. For many, it’s a delicate balancing act, with each challenge impacting the others. The result is a sector that’s resilient and adaptable, but also under real strain as it tries to keep pace with a rapidly changing environment.

What’s Driving These Challenges?

The challenges facing UK trade businesses in 2025 are the result of a complex web of economic, social, and industry-specific factors. Our survey data, combined with national reports, reveals that these issues are deeply interconnected and shaped by both long-standing trends and new pressures.

1. The Relentless Skills Gap

The shortage of skilled tradespeople remains a top concern for the sector. This is not just a short-term blip. It’s the culmination of years of declining apprenticeship rates, an ageing workforce, and persistent negative perceptions about careers in the trades. Many young people have been steered towards academic routes, leaving fewer to enter vocational training or apprenticeships. At the same time, a large proportion of experienced tradespeople are reaching retirement age, creating a vacuum that isn’t being filled quickly enough.

The result? Demand for skilled workers in plumbing, electrics, gas, and renewables is outpacing the supply, causing project delays, pushing up wages, and making recruitment fiercely competitive. This skills shortfall is further intensified by the UK’s ongoing housing crisis and major infrastructure projects, both of which require a steady supply of qualified labour.

2. Economic Downturn, Rising Costs, and Supply Chain Disruption

Trade businesses across the UK are feeling the squeeze from multiple directions. Inflation, higher employment costs, and ongoing global economic uncertainty are putting significant pressure on margins. The Confederation of British Industry (CBI) forecasts UK GDP growth of just 1.2% in 2025, reflecting a slowdown driven by weak demand and escalating costs. Recent changes in the Autumn Budget, including increased National Insurance and a higher National Living Wage, are directly impacting payroll expenses, forcing many firms to rethink hiring and investment plans.

Compounding these financial pressures are persistent supply chain disruptions. Global geopolitical tensions and new US tariffs have driven up the price of materials and caused delays, making it even harder for trades to deliver projects on time and within budget. Nearly a third of mid-sized UK businesses are grappling with significant supply chain issues, and many anticipate needing financial support just to weather the storm. For tradespeople, this means longer lead times, higher day-to-day costs, and increased difficulty in planning and quoting for work. These are often challenges that are particularly acute for mid-sized and smaller firms who often lack the financial buffers of larger companies.

The wider economic climate that is generally marked by slow growth, cautious consumer spending, and unpredictable global trade relations, creates a backdrop of ongoing uncertainty. However, there is a glimmer of hope on the horizon. The government’s new Trade Strategy aims to unlock billions in growth and make the UK more agile and connected. Crucially for the trades, this strategy is may help address many of the root causes of high material costs, such as tariffs and regulatory barriers. By streamlining trade processes, supporting UK exporters, and improving access to global markets, the new Trade Strategy could help lower the cost of materials and equipment for UK businesses in the coming years. While these benefits may take time to reach the front line, they represent a positive step towards easing the burden on the UK’s trades and improving long-term business resilience.

3. Supply Chain Disruption and Global Trade Uncertainty

Supply chain challenges have become a defining feature of the post-pandemic economy. Delays, inventory shortages, and the threat of new tariffs are disrupting operations and making it harder for businesses to meet customer demand. Nearly a third of mid-sized UK businesses are grappling with significant supply chain issues, and many anticipate needing financial support to weather the storm. For trades, this means longer lead times, higher costs, and increased difficulty in planning projects.

4. Regulatory and Compliance Pressure

The regulatory landscape is always changing, with new rules around building safety, environmental standards, and workforce training. Keeping up with these changes is a particular challenge for small businesses and sole traders, who often lack dedicated compliance staff. Ongoing requirements for Continuing Professional Development (CPD) add to the administrative burden, and the cost of compliance, both in time and money, can be significant.

5. Marketing, Customer Acquisition, and Brand Building

Competition for customers is intensifying as more businesses enter the market and consumers become more selective. Standing out requires investment in marketing, digital presence, and customer service and are often areas where many traditional trade businesses have less experience or resources. The need to build trust and a strong reputation is more important than ever, especially as word-of-mouth and online reviews play a growing role in customer decision-making.

As the head of marketing at Logic4training and having experience in this field, I’d suggest setting up or optimising Google My Business, asking all of your current and previous customers to leave a review on Google or Trustpilot. Additionally, we have an article that focuses on Customer Service & Client Expectations in the Trades, should you want to gain an insight into communication between tradespeople and customers.

If you are looking for a comprehensive plan on how to improve your marketing and business acquisition, AI can assist you. Personally, I use and prefer Perplexity, but ChatGPT, Claude, Gemini and Grok are all great options to help you with this. You can use this prompt to help get started, as it provides a detailed action plan:

I am a [trade] looking to improve my marketing, customer acquisition, and brand building. Please develop a comprehensive plan that achieves this goal.

Here are some details about my business: [I/We] have been operating for [months/years] in [location] and offer [services] to [target audience].

Below is a list of essentials that [I/we] are looking for, as well as the plan:

[List things you need, such as a logo or website].

It can seem overwhelming at times with what you need to do on a marketing front, especially when your job is to be out on the tools. With the help of AI, you can streamline the process. However, if you feel that it is too much to handle or you don’t want to handle the marketing side of your business, there are agencies available that can assist you.

6. Technology Adoption and the Renewable Transition

The push towards renewables and green technology is creating both opportunities and challenges. Businesses must invest in new skills, tools, and training to stay competitive, but the cost and complexity of this transition can be daunting, especially for smaller firms. Those who can upskill and diversify are better positioned for growth, but the up-front investment is a real barrier for many.

In summary

UK trade businesses are navigating a perfect storm of skills shortages, rising costs, regulatory demands, supply chain disruptions, and shifting customer expectations. These challenges are deeply rooted in broader economic, demographic, and policy trends, and overcoming them will require coordinated action from industry, government, and training providers alike.

How Trade Businesses Are Experiencing the Skills Shortage

Despite some national reports suggesting the UK may have passed the peak of the skills gap, our survey tells a more nuanced story. We ask our respondents three questions to gauge their thoughts on the current situation.

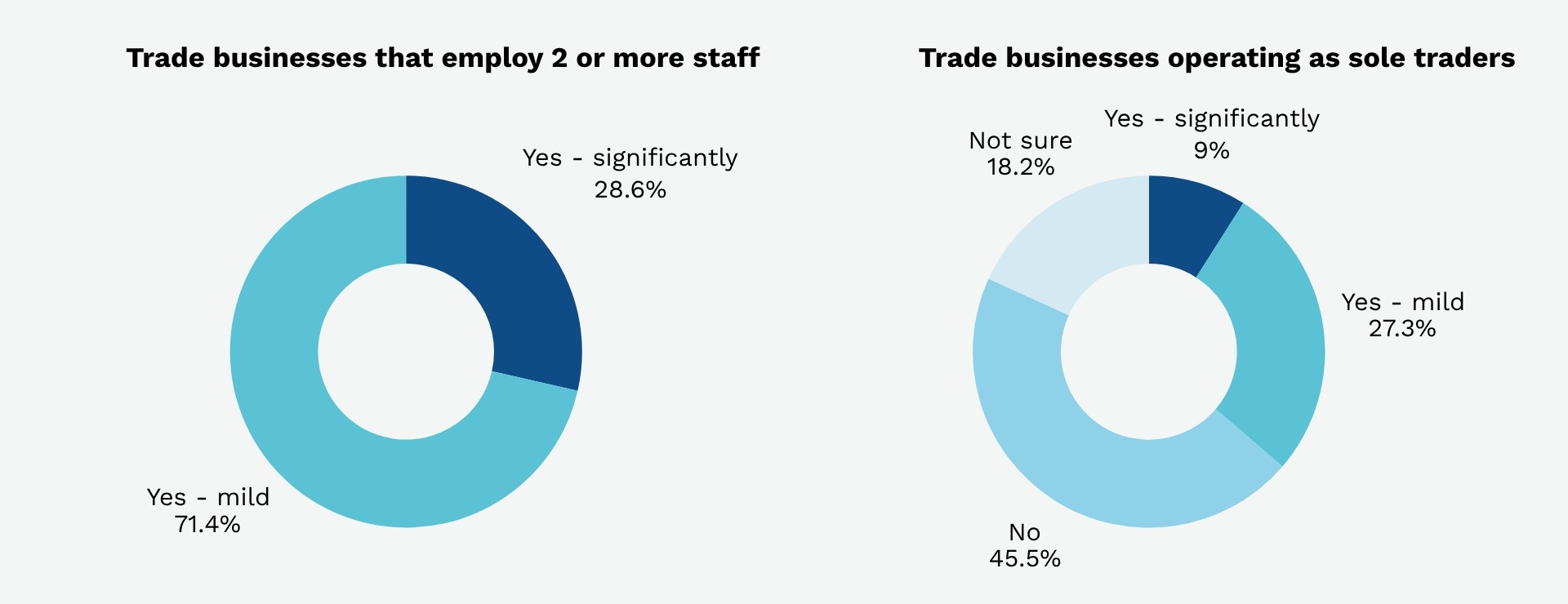

Are You Currently Experiencing a Skills Shortage?

- As a whole, 56.9% of respondents say they are currently experiencing a skills shortage in their business, with a further 12% unsure, suggesting the true figure could be even higher.

- The severity varies. About one in four report a “significant” shortage, while the remainder describe it as “mild.”

- When broken down, 100% of businesses that employ two or more people reported facing a skills shortage.

Skills shortages are widespread, especially among businesses employing two or more staff, all of whom reported some level of shortage. Sole traders are less affected, but a significant minority still face challenges, and a notable portion are unsure about their situation.

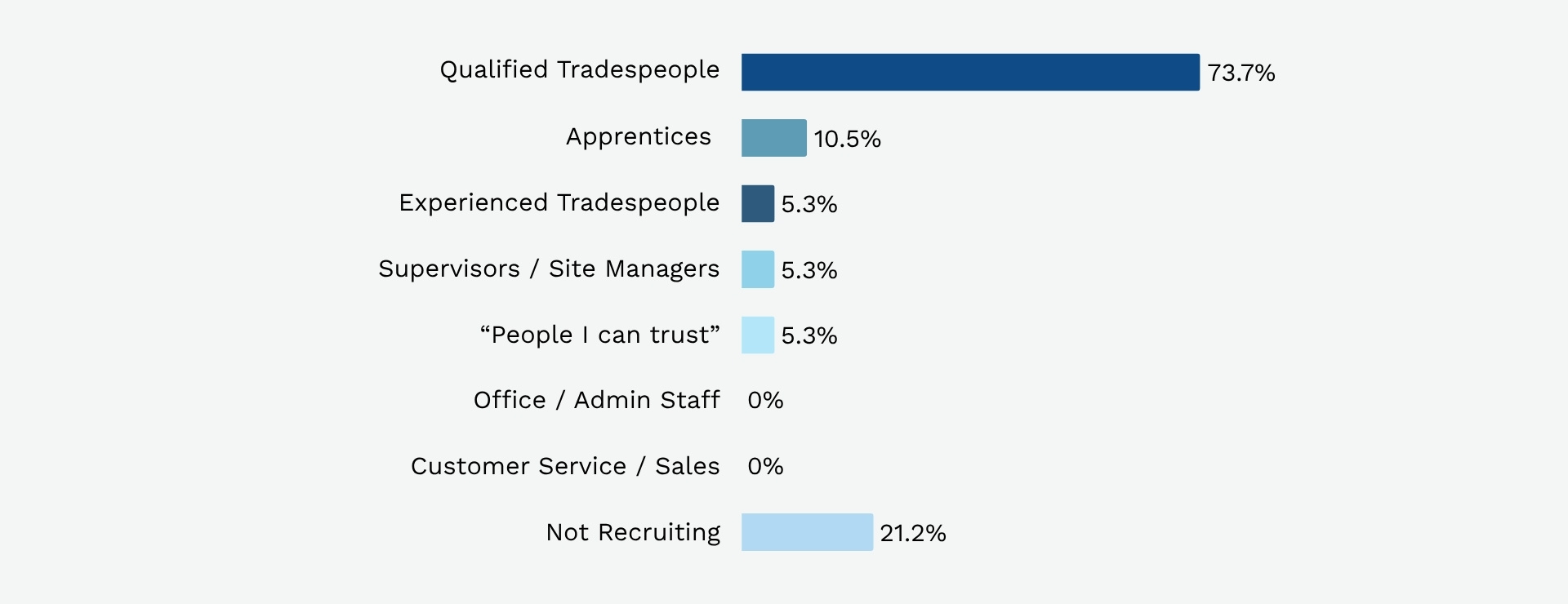

Which Roles Are Hardest to Recruit For?

- Qualified tradespeople are by far the hardest to find. This was the top answer across nearly every trade and business size.

- Apprentices and experienced engineers are also in short supply for businesses that employ between 2 and 10 people and are looking to grow or expand into new areas like renewables.

- Larger firms (21+ staff) were the only ones that highlighted the challenge of recruiting supervisors and site managers in addition to frontline trades.

- Interestingly, 36.3% of sole traders noted that they are not looking to recruit.

This highlights a significant shortage of skilled tradespeople in the sector, while recruitment for support or non-trade roles is not currently a major issue.

Note: Respondents could select more than one option. Percentages reflect the proportion of respondents who selected each option, not a total of 100%

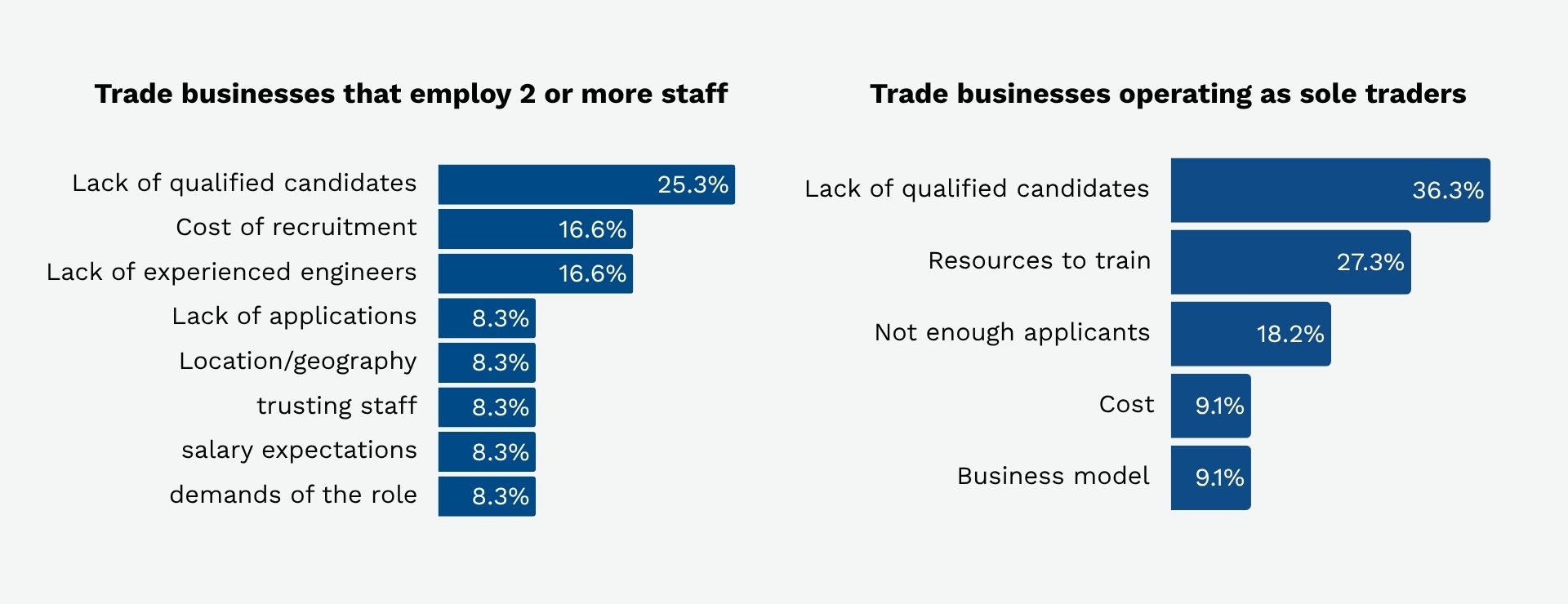

What Are the Biggest Barriers to Hiring New Staff?

The survey data shows a range of obstacles, but some clear trends emerge:

- Lack of qualified candidates: Cited by nearly two-thirds of those struggling to hire, this remains the single biggest barrier.

- Cost of recruitment and training: Around 40% said the time and resources needed to recruit and upskill new hires are a major hurdle.

- Location/geography: Especially for businesses outside major cities, attracting talent is even harder.

- Salary expectations and demands of the role: Larger businesses in particular report that expectations around pay and job demands can be a sticking point.

- Trust and reliability: For sole traders, finding “people I can trust” is a recurring theme.

How Are Trade Businesses Responding?

Despite facing a daunting mix of skills shortages, rising costs, and regulatory pressures, UK trade businesses are showing remarkable resilience and adaptability. Our survey data reveals a sector that’s not simply waiting for solutions from above but is actively experimenting with new strategies to survive and thrive.

Prioritising Upskilling and Continuous Professional Development (CPD)

A significant portion of respondents are investing in upskilling themselves or their teams. This includes formal training, short courses, and regular CPD to keep pace with new regulations and technologies. Businesses that regularly engage with training providers are better positioned to fill skills gaps internally, reduce reliance on external recruitment, and maintain compliance in a rapidly changing environment. This approach is especially prevalent among those expanding into renewables or adopting new tech, where the learning curve is steep and ongoing.

Embracing Apprenticeships

Many trade businesses, particularly those with two or more staff, are turning to apprenticeships as a practical, cost-effective way to bring in fresh talent and build skills from within. Apprenticeships not only help fill immediate skills gaps but also create a pipeline of loyal, well-trained employees who understand the company’s culture and standards. Government incentives and the apprenticeship levy make this route increasingly attractive, especially for SMEs looking to future-proof their workforce without excessive recruitment costs.

Selective and Strategic Recruitment

Where hiring is necessary, businesses are becoming more targeted. They’re focusing on recruiting for the most business-critical roles—primarily qualified tradespeople and, to a lesser extent, experienced engineers, apprentices, and supervisors. However, the data shows that many sole traders and micro-businesses are choosing not to recruit at all, instead relying on their own skills and trusted subcontractors to manage workload fluctuations. This cautious approach helps control costs and reduce risk in an uncertain market.

Adopting New Technologies and Expanding into Renewables

A growing number of businesses are investing in new tools, digital platforms, and green technologies. This includes everything from workflow software and customer relationship management (CRM) systems to heat pumps, solar PV, and EV charging installations. Those who diversify into renewables are not only tapping into new revenue streams but also future-proofing their business against changing regulations and consumer demand. However, this transition requires upskilling and often significant upfront investment, which remains a barrier for some.

Building Stronger Brands and Improving Customer Acquisition

With competition intensifying, many trades are focusing on marketing, brand building, and customer service. This includes optimising their online presence, encouraging customer reviews, and leveraging digital advertising. Businesses that invest in their reputation and visibility are better able to attract new customers and command premium rates, even in a crowded market. For some, this means seeking external marketing support or using AI-powered tools to streamline their efforts.

Flexible Workforce Planning

Some respondents are exploring more flexible workforce models, such as using contingent staff or blending permanent and temporary workers. This approach helps manage peaks in demand without committing to long-term payroll increases. It also allows businesses to access specialist skills on a project-by-project basis, reducing the impact of skills shortages.

In summary

Trade businesses in 2025 are not standing still. There are many looking to invest in upskilling, apprenticeships, and technology, strategically recruiting as well as building stronger brands to weather economic headwinds. While challenges remain, those who are proactive and adaptable are best placed to succeed in a rapidly evolving industry. For practical support, Logic4training offers a full suite of courses, apprenticeship guidance, and business growth resources to help you stay ahead.

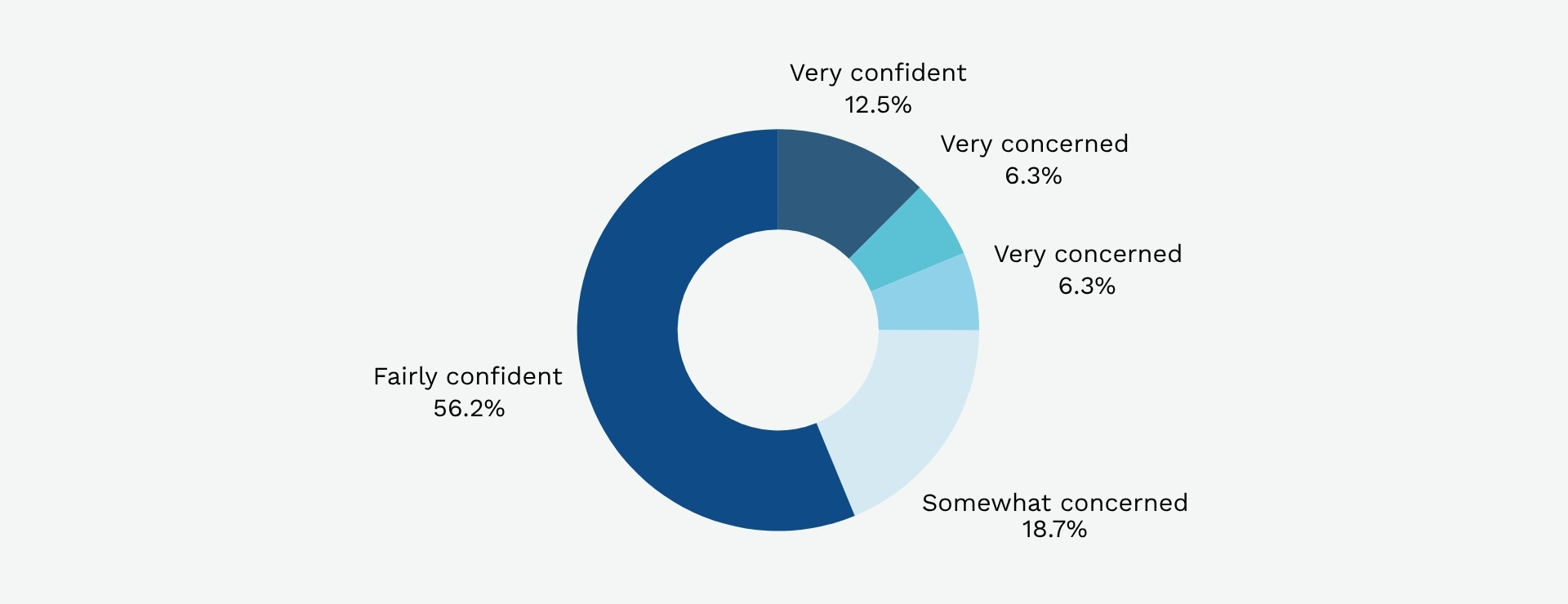

How Confident Do Tradespeople Feel About the Next 12 Months?

Our survey data reveals a mixed but generally positive outlook among UK tradespeople for the year ahead. Nearly half of the respondents (47.4%) described themselves as fairly confident about their business prospects over the next 12 months. This group is optimistic but realistic.

A further 21.1% of tradespeople reported feeling neutral. These respondents are neither particularly optimistic nor pessimistic and are likely waiting to see how the market develops before making any major business decisions. For many in this group, ongoing uncertainty around costs, recruitment, and compliance is a key factor in their cautious stance.

On the more concerned end of the spectrum, 15.8% of tradespeople described themselves as somewhat concerned about the future. This group often pointed to worries about cash flow, recruitment difficulties, and the impact of economic pressures on their business. Meanwhile, 5.3% said they were very concerned, typically due to persistent challenges in finding staff or managing rising expenses.

Despite these concerns, there is a core of strong optimism. 10.5% of respondents said they were very confident about the next 12 months. These businesses tend to have a clear strategy for growth and have diversified into new areas such as commercial and renewables.

Overall, the data suggests that while challenges remain, most UK tradespeople are facing the future with a practical sense of confidence, underpinned by adaptability and sector resilience.

Looking Ahead

Looking ahead, there are genuine reasons for UK trade businesses to feel optimistic despite the current pressures. Government initiatives, such as the new Trade Strategy and increased support for apprenticeships, are beginning to address the skills gap and open up new opportunities, particularly in renewables and green technologies. At the same time, the sector’s shift towards upskilling, digital adoption, and flexible workforce planning is helping businesses become more resilient and adaptable. While challenges like rising costs, supply chain disruption, and regulatory changes remain, those who invest in training, innovation, and strong branding are well placed to thrive. For ambitious tradespeople and business owners, the coming year offers the chance to future-proof their business, diversify their services, and build a skilled, sustainable workforce ready for whatever comes next

Your Partner for Success

At Logic4training, we’ve been at the heart of the UK’s trade sector for over 20 years. We work with thousands of candidates and businesses every year, providing industry-leading training, advice, and support. Our courses are designed by experts for both those with no experience and those who have many years of experience. We’re here to help you stay compliant, competitive, and confident in a fast-changing world.

- Trusted by trades: Our trainers are ex-tradespeople with real-world experience.

- Flexible learning: From online CPD to hands-on workshops, we fit training around your business.

- Up-to-date content: We stay ahead of regulatory changes so you don’t have to.

- Real results: Our candidates go on to build successful, sustainable businesses.

Ready to take your trade to the next level? Explore our full range of training courses or get in touch for tailored advice.

FAQs

What percentage of UK trade businesses are experiencing a skills shortage?

Over 56.9% of businesses surveyed by Logic4training reported some level of skills shortage in 2025.

What are the main barriers to hiring new staff?

The biggest barriers are a lack of qualified candidates as well as the cost and time required for recruitment and training.

How many businesses are expanding into renewables?

Nearly 30% of respondents are actively exploring or expanding into renewables such as heat pumps, solar PV, and EV charging.

How many trade businesses offer regular CPD or training?

Only about a third of businesses surveyed offer regular CPD or training to their staff.

What support does Logic4training offer for addressing these challenges?

Logic4training offers a wide range of courses in gas, electrical, renewables, and more, plus expert advice and flexible learning options.