Insights

View our latest insights, guides and case studies

Insights | 8th July 2025

A Complete Guide to Competent Person Schemes

Read more

Insights | 8th July 2025

The Dangers of F-Gases: What You Need to Know

Read more

Insights | 7th July 2025

Not Going to Uni? Consider a Career in the Trades

Read more

Insights | 4th July 2025

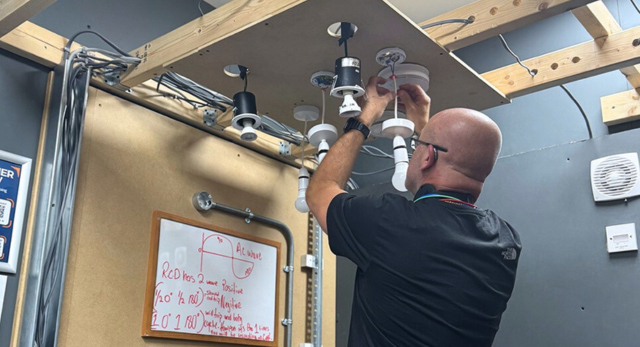

Training with Logic4training

Read more

Insights | 30th June 2025

Trades vs Uni: Your Path, Your Choice!

Read more

Insights | 30th June 2025

Apprenticeship funding rules explained

Read more

Case Studies | 28th June 2025

Govind’s NEDEI Experience

Read more

Insights | 27th June 2025

Challenges Facing UK Trades Businesses in 2025

Read more

Insights | 24th June 2025

Where to Install a Consumer Unit in the UK

Read more

Insights | 23rd June 2025

AI Job Losses & Why Tradespeople Are Safe from AI

Read more

Insights | 18th June 2025

How to Bleed a Radiator: The No-Nonsense Guide

Read more

Insights | 17th June 2025