Insights

View our latest insights, guides and case studies

Insights | 24th April 2024

The role of trades in a sustainable future

Read more

Insights | 12th April 2024

Trade School vs. Traditional Education: Choosing the Right Path for Your Career

Read more

Insights | 5th April 2024

Do you want to become a plumber?

Read more

Case Studies | 28th March 2024

Thoughts from the Brentwood Plumber

Read more

Insights | 26th March 2024

Unlock your potential! Why vocational training is the key to a new career in 2024

Read more

Insights | 22nd March 2024

Options Skills Closure: Supporting Trainees

Read more

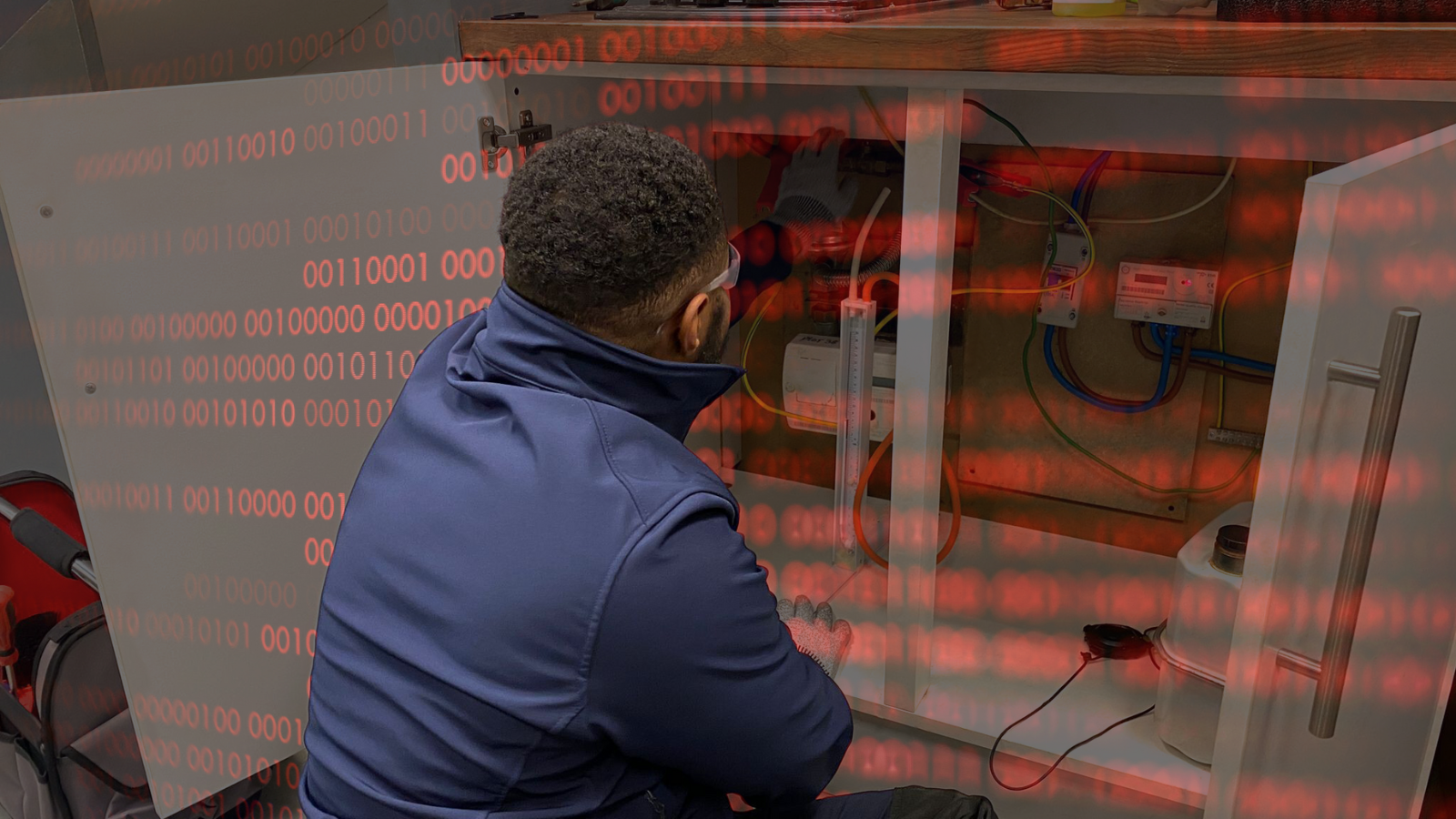

Case Studies | 11th March 2024

From Barista To Electrician – Hear Olha’s Story

Read more

Case Studies | 8th March 2024

Carolyn Opts For Plumbing After a Successful Corporate Career

Read more

Insights | 29th February 2024

University graduates vs tradespeople – who earns more?

Read more

Case Studies | 16th February 2024

From biotechnology to electrical installer – Syed’s story

Read more

Insights | 14th February 2024

Building services is an ‘AI beating choice for the next generation’

Read more

Insights | 7th February 2024